Translation and analysis of words by ChatGPT artificial intelligence

On this page you can get a detailed analysis of a word or phrase, produced by the best artificial intelligence technology to date:

- how the word is used

- frequency of use

- it is used more often in oral or written speech

- word translation options

- usage examples (several phrases with translation)

- etymology

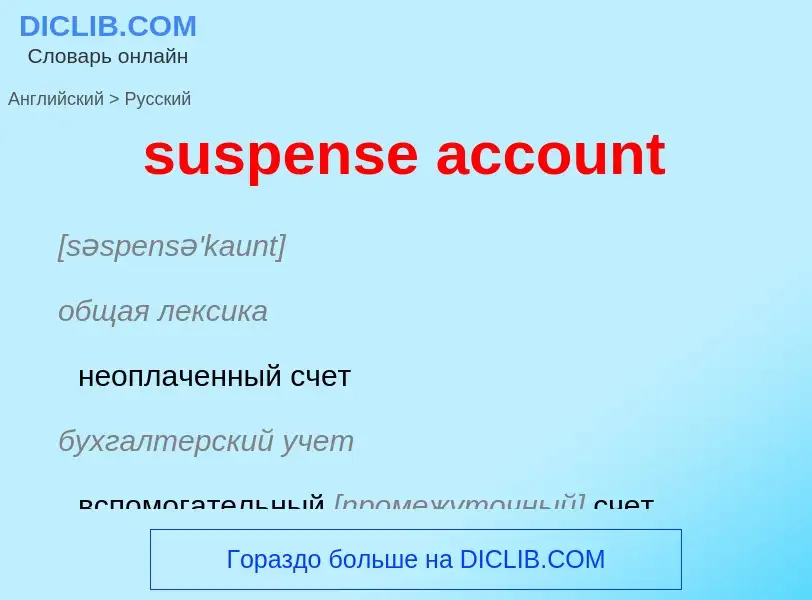

suspense account - translation to English

[səspensə'kaunt]

общая лексика

неоплаченный счет

бухгалтерский учет

вспомогательный [промежуточный] счет (временный (транзитный) счет для учета операций, затрат (платежей), доходов (поступлений), задолженности и т. д. до их окончательной классификации)

бухгалтерия

счёт переходящих сумм

синоним

2) вспомогательный счёт; промежуточный счёт; счёт переходящих сумм

Definition

Wikipedia

A suspense account is an account used temporarily to carry doubtful entries and discrepancies pending their analysis and permanent classification.

It can be a repository for monetary transactions (cash receipts, cash disbursements and journal entries) entered with invalid account numbers. The account specified may not exist, or it may be deleted/frozen. If one of these conditions applies, the transaction should be directed to a suspense account.

In branchless banking (BB) - banking through mobile for the unbanked - these accounts are used for 'money-in-transit'. For example, sender sends payment from US ACH account to a BB mobile number in Japan. The customer receives an alert on their mobile to withdraw this money from a BB agent. Until they withdraw, the remittance stays in a suspense account, earning the financial institute or the BB enabler float/interest on that money. When customer withdrawal is completed, the money moves from the suspense account to the account of the agent who facilitated the cash withdrawal.

A suspense account is an account in the general ledger in which amounts are temporarily recorded. A suspense account is used when the proper account cannot be determined at the time the transaction is recorded. When the proper account is determined, the amount will be moved from the suspense account to the proper account. It can also be used when there is a difference between the debit and credit side of a closing or trial balance, as a holding area until the reason for error is located and corrected.

Suspense accounts should be cleared at some point, because they are for temporary use. Suspense accounts are a control risk.

- 2.jpg?width=200)